- How to Calculate Credit Score in UAE

- What is a Credit Score?

- Who Calculates Credit Scores in UAE?

- Where to Check Credit Score for Free?

- How is Credit Score Computed?

- What is a Good Credit Score in UAE?

- Why is Your Credit Score Important?

- Common Myths to Calculate Credit Scores in the UAE

- Frequently Asked Questions

How to Calculate Credit Scores in the UAE

How to Calculate Credit Score in UAE

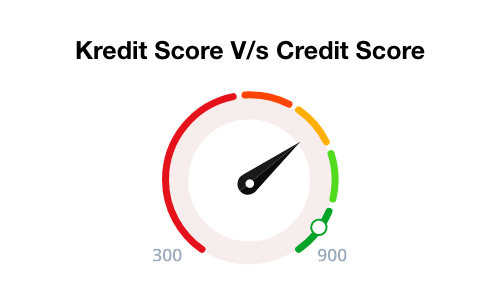

Your credit score is one of the most important numbers in your financial life, especially if you're planning to apply for a loan, credit card, or even rent a house. In the UAE, the al etihad credit bureau (AECB) tracks your financial activity and assigns a score ranging from 300 to 900.

But how to calculate credit scores? And what factors impact it the most? Let’s learn together.

What is a Credit Score?

A credit score is a 3-digit number ranging from 300 to 900 that reflects your creditworthiness. In simpler terms, it shows how reliable you are in repaying your loans or bills. The higher your score, the more financially trustworthy you appear to banks and lenders — this leads to faster approvals, higher loan amounts, and better interest rates.

Who Calculates Credit Scores in UAE?

In the UAE, the Al Etihad Credit Bureau (AECB) calculates credit scores. It collects financial data from banks, telecom providers, and other institutions to compile your credit report and generate your score.

While you can check your score through the official website or app, keep in mind that it’s a paid service. The bureau charges AED 84 for a credit report and AED 10.50 for only the score.

Where to Check Credit Score for Free?You can easily check your credit score for free on Paisabazaar! We partner with AECB to help you make a score check without paying any fees. Simply fill out the form in the ‘credit score’ section to get started! |

How is Credit Score Computed?

Wondering ‘credit score, how is it calculated?’

Here is an overview of the factors usually considered by the AECB —

1. Bill Payment History

- Problem: Late or missed payments on credit cards, loans, or utility bills are one of the biggest red flags. Even a single delay can harm your credit score.

- Solution: Always pay your dues on time and set reminders or enable auto-pay options to avoid missing deadlines. This can not only improve your score but also save you from penalties for late or missed payments.

2. Credit Utilisation Ratio

- Problem: Using a large portion of your credit limit (like maxing out your credit card) signals financial stress. This, in turn, pulls down your score.

- Solution: Try to keep your credit usage below your total available limit. As per experts, it’s advisable not to utilise more than 30% of the limit.For instance, if your total credit limit is AED 10,000, try not to go beyond AED 3,000 in utilisation.

3. Length of Credit History

- Problem: The older your credit history, the better it is for your score. However, having only new or recently opened credit accounts can negatively affect your score.

- Solution: Keep your old credit cards or loan accounts open, even if you don’t use them regularly. A longer history builds trust with lenders.

4. Credit Mix

- Problem: Relying only on one type of credit (e.g., just credit cards or just loans) can work against you. For a good score, a good mix of credit instruments is recommended.

- Solution: Aim for a healthy mix to show you can manage different types of credit responsibly. For example, if you only have a credit card, you can take a car loan or a loan for your next major purchase.

5. Number of Credit Inquiries

- Problem: Applying for multiple credit products in a short time leads to several ‘hard inquiries’, which can lower your score temporarily.

- Solution: Only apply for credit when absolutely necessary. Space out your applications — don’t apply for too many cards or loans in one go. Also, research your options before applying.

By managing these factors well, you’ll be on the right track to building and maintaining a strong credit profile in the UAE.

Read More

What You Should Know About Hard Inquiry

What is a Soft Inquiry? Here is Everything You Should Know

What is a Good Credit Score in UAE?

Here’s how credit scores in UAE are generally categorised —

| Score Range | Rating |

|---|---|

| 750 – 900 | Excellent |

| 700 – 749 | Good |

| 650 – 699 | Fair |

| Below 650 | Poor |

Aim for a score above 700 to enjoy faster approvals and better financial products.

Read our article on What is a Good Credit Score for a better understanding.

Why is Your Credit Score Important?

Banks, landlords, telecom providers, and even employers may check your credit score before making a decision.

With a good score, you can —

- Secure better loan terms

- Boost credit card approvals

- Enjoy easier access to rental properties or postpaid services

- Demonstrate financial discipline

Common Myths to Calculate Credit Scores in the UAE

When searching for how to calculate credit score in the UAE, many among us stumble across several myths. Let’s clear the air by busting some of the most common myths —

✅ Myth 1: A High Salary Guarantees a High Credit Score

The Truth: Your income is not included in your credit score calculation.

Why This is a Problem: Many people with high salaries assume they don't need to worry about their score — until they’re denied a loan or credit card.

What Actually Matters: A person earning less but paying bills on time and using credit responsibly can easily have a higher score than someone earning more but missing payments.

✅ Myth 2: Checking Your Credit Score Frequently Lowers It

The Truth: Checking your own credit score is known as a soft inquiry. It does not impact your score.

Why This is a Problem: Many people avoid checking their score, thinking it will hurt them. However, they actually miss the chance to catch mistakes or improve early.

What to Do Instead: Feel free to check your score regularly through the Al Etihad Credit Bureau (AECB) website/app or Paisabazaar.ae. It’s a smart financial habit and won’t harm your score in any way.

✅ Myth 3: Only Loans Affect Credit Scores

The Truth: In the calculation of your score, your utility bills and any other regular financial commitments are also considered.

Why This is a Problem: Many residents ignore telecom and utility bills, not realising that missed payments can damage their score just like a loan default would.

What to Do Instead: Treat all your financial obligations — big or small — as important. Pay on time, whether it’s for your credit card or your telecom bill.

✅ Myth 4: Credit Scores are Only for People Seeking Loans

The Truth: Your score is used for much more than just loan approvals.

Why This is a Problem: Some people ignore their score, thinking, “I’m not applying for a loan anyway”. However, banks, landlords, telecom companies, and even employers may check your score before working with you.

What to Do Instead: Build and maintain a strong score — it reflects your trustworthiness and financial discipline.

Note: Improving your credit score is a gradual process. Even if you pay off all dues, it may take a few months before your score increases.

Final Thoughts

Whether you’re a resident or an expat, knowing how to calculate your credit score in the UAE is key to smart financial planning. By understanding the factors that influence your score and taking active steps to maintain a healthy credit profile, you’ll open doors to better financial opportunities in the future.

Need help managing your finances or improving your credit score? Reach out to a trusted financial advisor or explore educational tools available online through platforms like Paisabazaar UAE.

Frequently Asked Questions

Ans: No, your salary does not directly affect your credit score. Lenders may consider it when giving loans, but your score is based on your payment history and credit behavior.

Ans: Your score is affected by on-time payments, how much credit you use, how long you’ve had credit, and how often you apply for new credit.

Ans: You can check it through the AECB website or app by registering, verifying your identity, and paying a small fee. For free score checks, you can visit Paisabazaar.ae.

Ans: No, checking your own score is a ‘soft inquiry’ and doesn’t affect your score.

Ans: Missing payments, bounced cheques, exhausting all your credit limit, or having too many loans can damage your credit score.

Ans: If you find an error, you can contact the AECB. The bureau can raise the issue with the bank or company that shared the wrong info.

| Credit Score for different types of Loan | |||

|---|---|---|---|

| Credit Score for Personal Loan | Credit Score for House Loan | Credit Score for Car Loan | Credit Score for Student Loan |

More From Credit Score

- Recent Articles

- Popular Articles