Credit Card in Dubai, UAE

Credit card presents a convenient banking facility to borrow money when you need it. It comes with a set credit limit, which can be used for urgent cash requirements, bill payments, and other regular purchases. With a credit card, you pay the issuer later without any interest — as long as the ...read more

Credit Card in UAE

Credit cards in Dubai, UAE are used for purchases or paying bills without using cash or a debit. Many banking institutions even offer you a pre-approved credit limit that you can use and repay later, often with up to 55 interest-free days if paid in full on time.

Many credit cards in UAE come with added benefits like cashback, airport lounge access, travel insurance, and reward points. Whether for daily spending or emergencies, a card, when used responsibly, helps you manage finances, build credit history, and access lifestyle privileges tailored to your needs.

Key Features & Benefits of Credit Cards

Here are the top features that you can get with a typical credit card in Dubai, UAE —

| Type of Features & Features | Description | Apply |

|---|---|---|

| Movie Discounts |

|

View Offers |

| Golf Access |

|

View Offers |

| Dining and Shopping Deals |

|

View Offers |

| Flight and Hotel Booking Offers |

|

View Offers |

| Valet Parking Facilities |

|

View Offers |

Summary of Available Credit Cards in UAE with Annual fees, Minimum Salary required & Key Feature

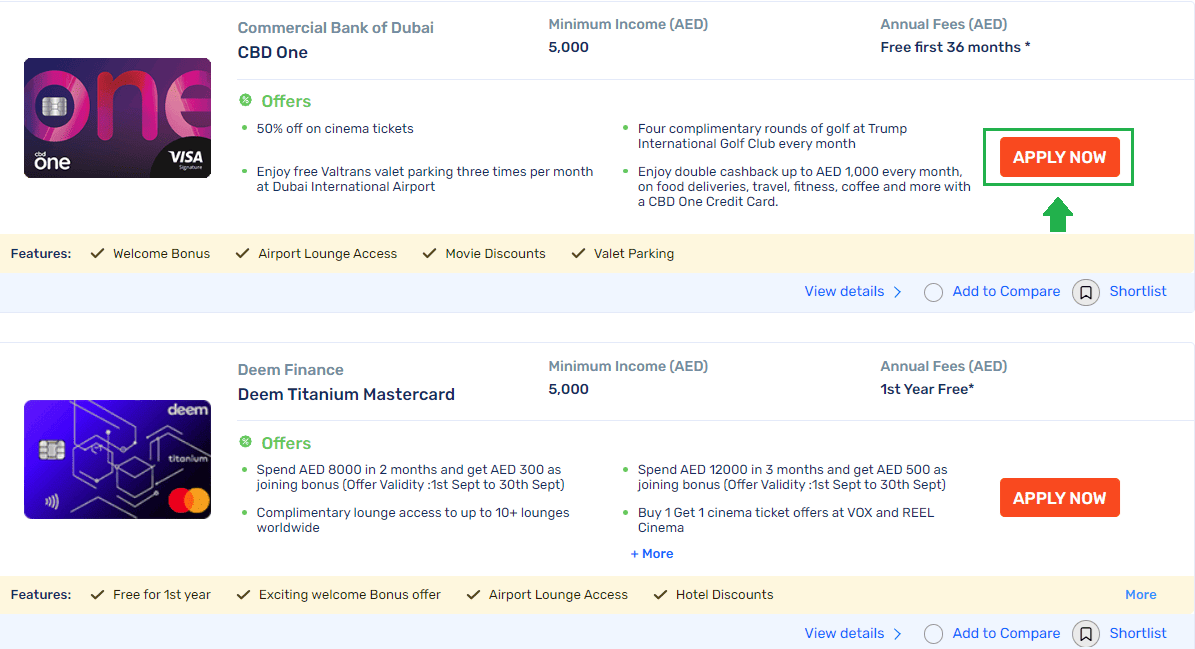

Having understood the top categories, let’s take a look at some of the best credit cards in Dubai. We will also explore their important features and requirements to help you gain clarity and make an informed decision.

| Credit Card | Minimum Salary Requirement | Annual Fee | Key Feature |

|---|---|---|---|

| Liv. Cashback Card | AED 5,000 | No Annual Fee | Cashback |

| Citibank Citi Simplicity Card | AED 5,000 | No Annual Fee | Free for Life |

| HSBC Live+ Card | AED 5,000 | Free for the First Year AED 299 From Second Year Onwards | Cashback |

| FAB Rewards Indulge Card | AED 5,000 | No Annual Fee | Reward Points |

| Deem Finance Titanium Mastercard | AED 5,000 | Free for the First Year AED 200 From the Second Year Onwards | Reward Points |

| Emirates NBD Mastercard Titanium Card | AED 5,000 | No Annual Fee | Free for Life |

| Emirates Islamic Cashback Card | AED 5,000 | AED 367.5 | Cashback |

| HSBC Max Rewards Card | AED 10,000 | Free for the First Year AED 600 From Second Year Onwards | Reward Points |

| Citibank Citi Ready Card | AED 8,000 | Free for the First Year AED 300 From Second Year Onwards | No Annual Fee for the First Year |

| NBQ Gold Card | AED 8,000 | No Annual Fee | Free for Life |

| Deem Finance Platinum Mastercard | AED 10,000 | No Annual Fee | Free for Life |

| FAB Low-Rate Card | AED 10,000 | AED 300 | Low Interest Rate |

| Emirates Islamic Cashback Plus Card | AED 12,000 | AED 313.95 | Cashback |

| Emirates NBD Lulu 247 Platinum Card | AED 15,000 | AED 262.5 | Welcome Bonus |

| Emirates Islamic Flex Elite Card | AED 15,000 | AED 735 | Reward Points |

| Citibank Citi Premier | AED 15,000 | AED 750 | Welcome Bonus |

| Emirates NBD Dnata World Card | AED 20,000 | AED 1,049 | Cashback |

| NBQ Infinite Card | AED 30,000 | AED 1,000 | Airport Lounge Access |

| Citibank Citi Prestige Card | AED 30,000 | AED 15,000 | Welcome Bonus |

| Citibank Citi Ultima Card | AED 36,750A | AED 3,000 | Travel Perks |

| Get Your Card Today | |||

Can I Apply for a Credit Card via Paisabazaar UAE?

Yes! On Paisabazaar.ae, you can easily apply for a credit card in UAE. You can compare your options and get the best card with instant approval.

Here’s how to apply through our portal —

Why Should I Apply for Credit Cards via Paisabazaar UAE?

Sign up today and unlock a world of benefits with Paisabazaar.ae. We are a top insurance and banking aggregator in the UAE, with customer satisfaction being our top-most priority!

- Our collaboration with prominent UAE banks brings you a wide range of credit cards

- We offer you a unique platform to compare cards from different providers

- Our customer-centric approach ensures 24/7 expert assistance

- Free access to our website’s ‘Articles’ section for all credit card-related information

- Hassle-free and quick application process

- Apply and avail of exclusive credit card offers

Applying for a credit card - Paisabazaar.ae vs Bank Websites

| Paisabazaar.ae | UAE Banks |

|---|---|

| Find credit cards from the top UAE banks on a single platform | Bank-specific cards, i.e. limited options |

| Compare similar cards from different lending institutions — easy research | Need to compare cards from multiple bank websites, requiring extensive research |

| Exclusive rewards and welcome bonuses | Limited seasonal bonuses and rewards |

| Get a credit card with detailed customer reviews | Usually, customer reviews are not listed on bank websites |

| Use filters to view cards as per specific requirements | No options to apply filters |

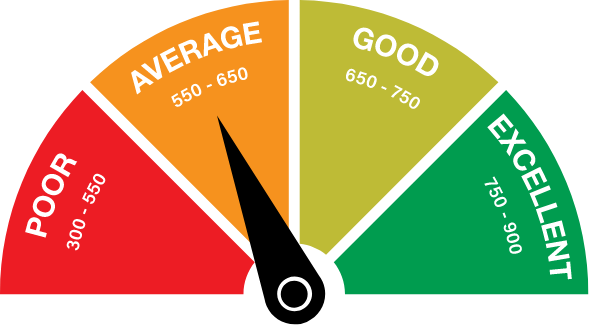

Can I Apply for Credit Card in UAE with a Low Credit Score?

Yes, you can apply, although getting a credit card with a low credit score in the UAE can be challenging. While it’s not impossible to get a card, a low credit score could limit the options available.

Your aecb credit score defines your creditworthiness. It represents your potential to manage finances and repay borrowed amounts to the bank within the given period.

Late payments, poorly managed loans, and multiple credit inquiries can significantly decrease your credit score. A low or poor score, in turn, can affect the approval of your credit card or loan applications.

So What’s the Alternative?

Secured credit cards, where a fixed deposit is held as collateral, may be offered if you have a low credit score. These cards can help you build your score while still offering access to credit facilities.

Improving your credit score by paying existing debts on time and keeping balances low can also enhance your chances. Know more on how to improve your credit score here!

Credit Card in UAE — Eligibility Criteria

Credit Card in UAE — Documents Checklist

Given below is a category-wise list of documents for credit card application verification in the UAE —

| For Salaried Individuals | For Self-Employed Individuals |

|---|---|

|

|

Note:

- All your documents must be valid and original.

- It’s recommended to keep a copy of each document handy.

- Your bank may ask for additional document(s).

Get the Best Credit Cards Quotes from Top Leading Banks in UAE

Fees & Charges of Credit Cards in UAE

Here are some of the major fees associated with UAE credit cards — let’s understand what they mean:

Annual Fee

Cash Advance Fee

Late Payment Fee

Balance Transfer Fee

Foreign Transaction Fee

Overlimit Fee

Card Replacement Fee

Sales Voucher Copy Fee

Card Statement Fee

The annual fee is a yearly charge levied by credit card issuers for using certain premium cards. This fee varies based on the card’s benefits — high-end cards offering rewards, travel perks, and bonuses often carry higher fees.

Some cards have waivers on the annual fee for the first year or for meeting spending requirements.

This fee is charged when you withdraw cash from an ATM using your card. This fee is usually a percentage of the amount withdrawn in addition to immediate interest charges. Cash advances often have higher interest rates compared to regular card purchases.

As the name suggests, this fee applies when you fail to make the minimum required payment within the due date. Repeated late payments can negatively impact your credit score and may result in higher interest rates being applied to the card balance.

This fee is imposed when you transfer outstanding debt from one credit card in UAE to another one that offers lower interest rates. While balance transfers can save on interest payments, you should carefully consider this fee, especially if the transferred amount is substantial.

This applies when you make purchases in a currency other than the UAE currency.

If you are a frequent international traveller, you can find certain cards that waive or minimise this fee to avoid extra charges.

When you exceed your assigned credit limit, an over-limit fee is levied. Banks generally allow overlimit spending for emergencies, but frequent overuse may lead to increased interest rates and negatively impact credit scores.

This fee is incurred when you request a new card due to loss, theft, or damage of the original card. Some banks waive this fee for premium cardholders or in certain circumstances, like stolen cards reported within a specific period.

It is charged when you request a physical copy of a transaction receipt. While many transactions can be verified through online statements, this fee may apply for disputes or proof of purchase when electronic records are insufficient.

A card statement fee is charged when you request a physical copy of your credit card statement. It is advisable to opt for digital statements as they are environment-friendly and free of cost.

New Credit Cardholder Advantages

New credit card holders in the UAE can enjoy a range of benefits.

Firstly, many cards offer welcome bonuses such as reward points, cashback, or free air miles that provide immediate value. Some also provide easy access to instalment plans for major purchases, allowing you to spread payments over time without high interest.

Additionally, many UAE banks offer perks like free travel insurance, extended warranties, and access to exclusive airport lounges, enhancing travel experiences. Discounts on dining, shopping, and entertainment, along with the ability to earn loyalty rewards further add to the card's value.

Lastly, a credit card helps you build a good credit history. This is highly important for future financial applications like loans and other cards.

Know These Points Before Applying for a Credit Card in UAE!

What is a Credit Card Statement?

It is a detailed monthly report issued by your bank. This statement enlists all your transactions made during the billing period.

This report includes information such as purchases, payments, fees, interest charges, and the minimum payment due. It also highlights the total balance, available credit, and payment due date.

By regularly reviewing credit card statements, you can track spending, identify errors, and manage finances efficiently. You can choose paper or electronic statements. While the latter is more environment-friendly and free, paper statements may have a small fee.

What are the Applicable Card Fees and Charges?

Certain fees and charges are associated with a credit card. These include annual fees, interest rates, late payment fees, cash advance fees, foreign transaction fees, and more. These fees vary as per the card type, issuer, and cardholder’s usage.

Understanding these charges is essential for avoiding unnecessary costs. You must review terms and conditions carefully to stay updated with the fees that may apply based on your card activity.

Can I Withdraw Cash Using My Credit Card?

Yes, you can! Withdrawing cash through a credit card, known as a cash advance, allows you to access cash from ATMs. However, note that fees and interest rates are applied on cash advances.

Banks charge a percentage of the withdrawal amount and apply immediate interest on the cash. These rates, in fact, are often higher than standard card purchases.

This service is helpful for emergencies but is generally considered expensive. So it’s advisable to limit cash withdrawals via these cards unless necessary.

What are Reward Points?

Reward points are loyalty incentives offered by credit cards. These points are earned on card purchases. You can redeem them for various benefits such as flights, hotel stays, shopping vouchers, or exclusive experiences.

Different cards offer different reward structures, with some focusing on travel, retail, or lifestyle categories. Accumulating reward points is ideal for those who regularly use their cards for purchases and want to enjoy discounts and perks.

What is My Bill Payment Cycle?

A credit card bill payment cycle refers to the period between two consecutive statement dates, usually lasting 30 days. During this period, you make purchases — at the end of the cycle, a statement is generated showing the total amount owed.

A grace period is given to pay off the balance before incurring interest charges. Paying the full balance within the cycle helps avoid interest, while only paying the minimum will result in accumulating debt.

Do’s & Don’t of Credit Cards

We have explained the major do’s and don’ts of credit cards in the table below —

| What to Do? | What Not to Do? |

|---|---|

|

Explore Credit Card Options Before applying, thoroughly explore different options to find one that suits your lifestyle and financial needs. Compare features like interest rates, rewards programs, annual fees, and special benefits. UAE banks offer various cards tailored for travel, shopping, or cashback. Comprehensive research ensures that you maximise card benefits and avoid cards with hidden fees. |

Exceeding Your Credit Limit Make sure you don’t exceed your credit limit — this can bring overlimit fees and impact your credit score. Exceeding your card limit can also lead to higher interest rates. Banks usually offer credit alerts or notifications when you’re approaching your limit. Keep track of such alerts to manage your spending and avoid additional charges. |

|

Read the Terms and Conditions Always read the terms and conditions before applying for or using a credit card. These details outline important elements like interest rates, fees, rewards policies, and repayment terms. UAE banks have varied fee structures — understanding these terms can help you avoid unexpected charges, penalties, or unfavourable interest rates that can negatively impact your finances. |

Paying the Minimum Amount Due is a Big No Paying only the minimum due amount on your card will accumulate interest on the remaining balance. This can lead to significant debt over time. It’s advisable to pay your bill in full each month to avoid high interest rates and keep your finances under control. Clearing your full balance ensures you don’t fall into a debt cycle and maintain a healthy credit score. |

|

Stay Updated with Your Bill Date Make sure you stay updated with your credit card’s bill date to avoid late payments, which may result in penalties and interest charges. Banks keep sending reminders via SMS or email, helping you keep track of payment deadlines. Timely payments keep your credit score healthy and save you from late fees. You may consider setting up automatic payments to manage bills efficiently. |

Applying for Multiple Credit Cards at a Time Applying for multiple cards within a short span can negatively impact your credit score. Each application results in a hard inquiry on your credit report, lowering your score. Having too many cards can also lead to overspending, difficulty in managing payments, and increased fees, making it challenging to stay financially organised. |

|

Track Your Expenses Track your expenses regularly to avoid overspending on your credit card. By monitoring purchases, you can stay within your credit limit and manage your monthly payments better. Keeping an eye on expenses also helps identify fraudulent activity. Most banks and financial institutions provide easy online tools and mobile apps for tracking spending. |

Making Restricted Transactions Credit cards in UAE have restrictions on certain types of transactions such as gambling or purchasing prohibited items. Engaging in restricted transactions can result in penalties, account suspension, or even legal consequences. Always check your bank’s guidelines on prohibited purchases and use your card only for legitimate, approved transactions to avoid these risks. |

Pro Tips for Securing Credit Card Usage

Take these points into account when using your offline and online credit card —

- Keep changing your 4-digit PIN within a regular interval.

- Never share your card PIN with anyone as it can lead to misuse of your card.

- Always avoid using your card on suspicious websites as they may be fake.

- Stay updated with your transactions to keep track of any fraudulent or unauthorised transactions.

- Report your stolen card immediately to avoid any transactions.

UAE Credit Card Reward Points: How to Use Them?

Reward points are fundamentally loyalty points earned through spending on a credit card. For each eligible spend, you accumulate points. These can be further used for redemption.

Different cards offer different types of rewards, including travel miles, cashback, hotel stays, or shopping vouchers.

Using reward points is a straightforward process. After accumulating a certain number of points, you can redeem them through the bank’s online portal or app. Many UAE credit cards are linked with airline programs, such as Emirates Skywards or Etihad Guest. This allows you to convert points into air miles for free flights or upgrades.

Points can also be used for discounts at partner merchants, including restaurants, hotels, and shopping outlets.

Additionally, some reward points can also be exchanged for cashback. These are credited to your account to reduce outstanding balances. Understanding your card's specific rewards program helps you maximise the benefits and ensures you're getting the most value from your spending.

Read More About Salary Based Credit Cards

FAQs About Credit Card in UAE

More From Credit Cards

- Recent Articles

- Popular Articles